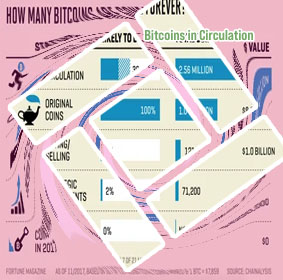

How many bitcoins are in circulation

With the increasing popularity of Bitcoin, many people are curious about how many bitcoins are currently in circulation. To help answer this question, we have compiled a list of four articles that provide valuable information on the topic. These articles cover various aspects of Bitcoin circulation, such as the total supply, mining process, and distribution among users. By reading these articles, you will gain a better understanding of the current state of Bitcoin circulation and how it may impact the future of the cryptocurrency market.

As the world eagerly anticipates the mining of the last bitcoin, many are left wondering what year this monumental event will occur. In order to shed some light on this topic, we have compiled a list of three articles that explore different aspects of the future of bitcoin mining. These articles provide valuable insights and expert opinions that can help paint a clearer picture of when the last bitcoin will be mined.

Predicting the Last Bitcoin: Experts Weigh In on the Future of Mining

Cryptocurrency mining has been a hot topic in recent years, with Bitcoin being the most popular digital currency to mine. However, as the supply of Bitcoin is limited to 21 million coins, many experts have been trying to predict when the last Bitcoin will be mined.

According to a recent study conducted by blockchain analytics firm Chainalysis, it is estimated that the last Bitcoin will be mined in the year 2140. This prediction is based on the current rate of Bitcoin mining and the algorithmic halving that occurs every four years, which reduces the reward for miners by half.

Experts in the field of cryptocurrency mining have weighed in on the future of Bitcoin mining, with some predicting that the increasing difficulty of mining will lead to a decrease in the number of miners. This could potentially result in a centralization of mining power, with only a few large mining pools dominating the market.

This article is important for those interested in the future of Bitcoin mining, as it provides valuable insights from experts in the field. By understanding the potential challenges and trends in Bitcoin mining, individuals and companies involved in cryptocurrency mining can better prepare for the future.

The Halving Effect: How Bitcoin's Supply Schedule Affects the Timeline for the Last Bitcoin

Bitcoin's supply schedule, known as the halving effect, is a key aspect of the cryptocurrency's design that has significant implications for its scarcity and value. Every four years, the reward for mining new bitcoins is halved, leading to a gradual reduction in the rate at which new coins are created. This process is hard-coded into Bitcoin's protocol and serves to mimic the scarcity of precious metals like gold.

The halving effect has a direct impact on the timeline for the last Bitcoin to be mined. As the reward for mining decreases over time, the rate at which new bitcoins are produced slows down. This means that the final Bitcoin will not be mined until the year 2140, according to Bitcoin's original whitepaper.

Key points to consider about the halving effect include:

- Scarcity: The halving effect ensures that Bitcoin becomes progressively scarcer over time, leading to a fixed supply of 21 million coins.

- Supply and demand: With a limited supply of bitcoins, the halving effect can drive up demand and potentially increase the value of the cryptocurrency.

- Mining economics: Miners must adapt to the halving effect by optimizing their operations to remain profitable in the face of reduced rewards.

Technological Advancements and the Race to Mine the Last Bitcoin: A Timeline of Events

none